LAW OFFICE OF

ROBERT J. MINTZ

Exclusive Legal Representation For Your

Asset Protection Planning Needs

Asset Protection

Estate Planning

International Tax

Business Planning

LAW OFFICE OF

ROBERT J. MINTZ

Exclusive Legal Representation For Your

Asset Protection Plannings Needs

Asset Protection

Estate Planning

International Tax

Business Planning

Types of Trusts for Asset Protection

The entity known as a trust will be essential in creating various strategies for accomplishing asset protection, estate planning, and privacy benefits. This chapter will provide a background for understanding how these techniques work and how a trust will be a part of your overall plan.

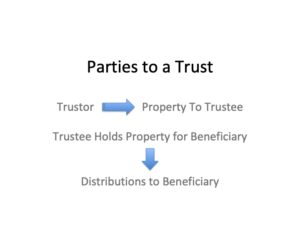

The legal arrangement, known as a trust, has been around for at least several hundred years. Every trust has certain essential characteristics. A trust has one or more trustees, who are responsible for administering and carrying out the terms of the trust. The beneficiaries are those who are entitled to trust income or principle either currently or at some time in the future.

A trust is typically in the form of a written trust agreement between the settlor, the person creating the trust, and the trustee. The written trust agreement provides that the settlor will transfer certain assets to the trustee and the trustee will hold those assets for the benefit of the named beneficiaries. (The terms “trustor” or “grantor” are used interchangeably with the term “settlor.”)

Until recently, trusts were used almost exclusively by the wealthiest families to maintain privacy and to pass their wealth to succeeding generations. The privacy benefits were particularly important. Grandpa Robber Baron had no desire to allow the muckraking newspapers and the antagonistic public to know exactly what he owned and how much he was worth. Grandpa was savvy enough to know that revealing the details of his fortune was not good for business and wasn’t smart politics. The Vanderbilts, Whitneys, Rockefellers, and Carnegies created trusts which have now successfully shielded from public scrutiny the family wealth of five or more generations.

But it is no longer only the wealthy who are attracted to the powerful benefits offered by a properly designed trust. All wealthy individuals and families create a network of trusts for asset protection, estate planning and charitable endeavors.

Now, even those with equity in the family home or some savings put away for retirement or college are using trusts as an essential ingredient in their asset protection and estate plans.

Trusts are extremely flexible in form and almost any asset protection and estate planning goal can be accomplished by an attorney who is knowledgeable and experienced in this field. Using creative trust strategies, the planning opportunities for achieving tax savings and asset protection advantages are unlimited. The following examples will provide you with an overview of some of the techniques that can be used to achieve particular objectives in a variety of circumstances.

Revocable Living Trust

A revocable living trust is a trust that can be revoked or canceled at any time by the settlor. The term “living trust” means simply that the trust is established during the lifetime of the settlor. (Testamentary trusts, those created upon the settlor’s death, do not avoid probate and are not nearly as popular today as they once were.) During the past ten or fifteen years, revocable living trusts have gained enormous popularity as a sound technique for accomplishing a number of legitimate estate planning goals. Read More

Irrevocable Trusts for Asset Protection and Tax Planning

The legal arrangement known as an Irrevocable Trust is one of the most important tools for business asset protection and protecting wealth. An Irrevocable Trust can produce significant business, tax and asset protection advantages in addition to traditional estate planning benefits. An irrevocable trust is generally designed to accomplish a specific business, tax or estate planning purpose which involves removing particular assets from the trustor’s “balance sheet.” Depending on the particular goal and what is intended to be achieved, an irrevocable trust provides appropriate restrictions on the powers of the trustor and trustee so that relevant legal and tax rules are properly accounted for. Read More

California Private Retirement Plans

California allows for the creation of a Private Retirement Plan, which is entirely exempt from judgments and bankruptcy. That is, retirement savings plans which are not IRS Qualified Plans may be protected under state law if certain requirements are satisfied. According to the cases that have been decided, these plans must be carefully drafted and maintained, but they are highly flexible in design, need not cover other employees, and can include annual contributions that can substantially exceed those available under the qualified plans or IRAs. Read More

California allows for the creation of a Private Retirement Plan, which is entirely exempt from judgments and bankruptcy. That is, retirement savings plans which are not IRS Qualified Plans may be protected under state law if certain requirements are satisfied. According to the cases that have been decided, these plans must be carefully drafted and maintained, but they are highly flexible in design, need not cover other employees, and can include annual contributions that can substantially exceed those available under the qualified plans or IRAs. Read More

Offshore Trusts for Asset Protection

Offshore Trusts are often used as a component of a sophisticated asset protection plan. There are three planning structures typically established by a client to obtain the advantages of Offshore Trust protection. For shorthand purposes these different trusts can be referred to as the (1) A Traditional Offshore Trust; (2) A Safety Valve Offshore Trust; and (3) An Offshore Conversion Trust. The relative advantages and disadvantages of each are outlined below. Read More

Domestic Asset Protection Trusts

In 2017 Michigan became the 17th state to allow property and savings to be sheltered from lawsuits and creditor collection actions. These states and others which will follow provide significant planning tools through Domestic Asset Protection Trusts for individuals and businesses owners who wish to protect assets and limit potential exposure to liability risks. Read More

Family Savings Trusts

Family Savings Trusts

The term Family Savings Trust is a broad descriptive term for a trust intended to hold and protect assets against lawsuits and business risks. A Family Savings Trust is extremely flexible in form and can incorporate provisions, which combine the features of domestic and even offshore arrangements within the language of the plan documents. All of your assets can be held within the trust—but be governed by special terms appropriate for that asset. Read More

Dynasty Trusts-Do Your Kids Need Asset Protection?

Now, in these twenty-three states, a trust is permitted to exist for whatever term is chosen—even if it reaches far off generations many years in the future. In Nevada, a Dynasty Trust is permitted to last for up to 365 years. Who might want a trust lasting generations into the future? Read More

Life Insurance Trust

When a policy is held by the trust, the cash value and the proceeds are also protected from potential lawsuits and claims. A portion of family savings can be transferred to the trust each year and that amount can be used to fund a policy. Amounts invested in the policy are permitted by favorable tax laws to accumulate free of income tax. In this manner, large amounts of value can be built up over a period of years. Read More

Estate Freeze Trust

Freezing the value of assets which may appreciate in the future is another strategy which can be added to your planning. If it is anticipated that certain property will appreciate in value over the years, it often makes sense to include provisions in the Family Savings Trust to minimize or avoid estate taxes on one or more particular assets. Read More

Personal Residence Trust

A Personal Residence Trust is a good strategy to provide asset protection for the family home. Generally, our goal with a Personal Residence Trust is to protect the equity in the home, above the homestead amount, while preserving the tax benefits and the continued right to use and enjoy the house. That’s what most people want to accomplish. Read More

The Privacy Trust

The Privacy Trust is a descriptive name for the legal strategies designed to achieve financial privacy goals-a legitimate concern for many individuals. The Privacy Trust successfully conceals ownership of bank and brokerage accounts, the family home, rental properties, and interests in other entities. If you have established a corporation, Family Limited Partnership, or Limited Liability Company for business or asset protection purposes, the Privacy Trust adds a desirable level of confidentiality to your personal affairs. Depending upon the particular features included in the trust-in addition to the privacy advantages- formidable asset protection and estate planning benefits can be created. Read More

What is a Grantor Trust?

Stated briefly, a Grantor Trust is any trust in which the person establishing the trust (the “Grantor”) retains certain powers over the trust so that he or she is treated as the owner of trust property for income tax purposes. Taking advantage of the Grantor Trust rules will be advantageous in circumstances where the primary objective of the trust is asset protection-to protect personal or business assets from lawsuit or liability risks. If asset protection, rather than tax planning, is the primary objective, then we may wish to keep the overall plan neutral from an income tax standpoint. Read More