LAW OFFICE OF

ROBERT J. MINTZ

Exclusive Legal Representation For Your

Asset Protection Planning Needs

Asset Protection

Estate Planning

International Tax

Business Planning

LAW OFFICE OF

ROBERT J. MINTZ

Exclusive Legal Representation For Your

Asset Protection Plannings Needs

Asset Protection

Estate Planning

International Tax

Business Planning

Offshore Trusts for Asset Protection

Offshore Asset Protection Trusts are often formed in the Cook Islands and are used as a component of a sophisticated asset protection plan. There are three planning structures typically established by a client to obtain the advantages of Offshore Trust protection. For shorthand purposes these different trusts can be referred to as the (1) A Traditional Offshore Asset Protection Trust; (2) A Safety Valve Offshore Asset Protection Trust; and (3) An Offshore Conversion Asset Protection Trust. The relative advantages and disadvantages of each are outlined below.

Traditional Offshore Asset Protection Trust

Formation

An Offshore Asset Protection Trust is established in a jurisdiction such as the Cook Islands or other country which has adopted advantageous legislation similar to the Cook Islands asset protection laws. A trustee company in the Cook Islands is engaged to act as trustee of the Cook Islands trust, and the trust agreement with supporting documents are prepared.

Transfer of Funds

Once the necessary documentation has been executed, the Cook Islands trust is registered in accordance with local laws. Upon completion of the due diligence process, one or more financial accounts are then opened in the name of the Cook Islands trust. Sometimes an offshore LLC, owned by the trust is formed to hold the account. The client can generally choose among a number of well known banks which may be based in Switzerland, Singapore or the Cayman Islands, depending upon the purpose of the trust and the client’s preferences. When the client is satisfied that the account arrangement are satisfactory, the client will wire transfer funds from his or her current accounts to the newly established trust account. An Offshore Asset Protection Trust created and funded in this manner creates a number of asset protection advantages.

Advantages of an Offshore Asset Protection Trust

The primary advantage of the traditional offshore trust is that funds are immediately located outside the jurisdiction of a U.S court. A judgment creditor would have to overcome significant obstacles to obtain access to the funds. In countries such as the Cook Islands and others, a judgment rendered in the U.S. (or any other country) cannot be enforced in the trust jurisdiction. To prosecute a claim against the Cook Islands trust, the judgment creditor would have to go to the country where the trust is domiciled to retry the underlying case-an impractical requirement.

- A trust can be challenged on the grounds of fraudulent transfer but statutes of limitations on fraudulent transfers can be as short as one or two years. That means that the judgment creditor generally must challenge the trust within a period of one or two years from the date of the initial transfer. Additionally the standard of proof required for a creditor to prove fraudulent transfer is the difficult “beyond a reasonable doubt” rather than the lesser civil standard of a “preponderance of the evidence.”

A further advantage of the offshore asset protection trust is that a greater degree of flexibility can be achieved in the way in which the trust is established. The settlor of the trust can serve as a beneficiary, and the trust will still be valid under local law. This allows the settlor to retain a substantially greater degree of control and enjoyment over trust assets than would be permitted under U.S. law with a domestic trust.

Costs and Maintenance of Offshore Trust.

The asset protection advantages of an offshore trust must be considered in light of the initial legal and trustee fees as well as annual maintenance and filing requirements.

Safety Valve Offshore Asset Protection Trust

Rather than making an immediate transfer of funds, some clients prefer to maintain accounts in the U.S. but keep open the strategy of a transfer to an overseas account at some later date-depending on circumstances.

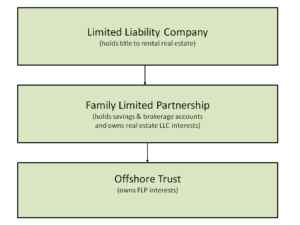

Under this structure, an offshore trust is created together with a domestic asset protection plan. The domestic plan consists of one or more vehicles such as Limited Liability Companies, Family Limited Partnerships, Family Savings Trusts, Private Retirement Plans, or Domestic Asset Protection Trusts.

Assets such as savings, real state and interests in other entities and businesses are transferred into an asset protection plan structured to accommodate these assets. Ownership of the domestic entities is transferred to the Offshore Trust or it can serve as Beneficiary of any domestic trusts which are created.

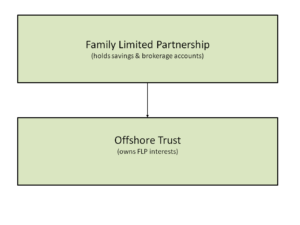

A variation on this plan is a FLP owning savings and brokerage accounts with the FLP substantially owned by the offshore trust.

When assets consist of investment properties an LLC can be added to own the investment properties.

Advantages of Offshore Asset Protection Safety Valve Trust

Keeping financial accounts and other assets in the U. S, under local control allows clients to maintain the convenience of their current accounts at domestic financial institutions, without the involvement of offshore trustees or advisors. Although the Offshore Trust has been formed, no funds have been transferred to it. The Offshore Trust simply owns whatever entities have been transferred to it. Or it owns nothing and acts as a beneficiary of a U.S trust.

The advantage of this arrangement is that some clients prefer the protection of an Offshore Asset Protection Trust while maintaining the convenience of holding accounts in the U.S. Also, during the time that assets are maintained within a U.S structure, filing requirements regarding foreign accounts and overseas trusts may be avoided. For tax and filing purposes the structure can sometimes be designed so that no returns of foreign entities or accounts need be filed. This is an advantage because the filing requirements for offshore entities have some level of associated complexity and cost.

The purpose of this structure is to create a sophisticated level of asset protection using U.S entities and trusts. For enhanced asset protection, the Offshore Asset Protection Trust serves a backup role- as a Safety Valve- and funds can be transferred from the U.S to the overseas account at a later point.

- Assets in the trust are protected by the most favorable asset protection laws-domestically and overseas.

- Legal leverage is maximized by forcing a legal adversary to litigate in a string of unfriendly foreign jurisdictions;

- All assets are managed by the client:

- Accounts and property remain in the U.S;

- The Offshore Asset Protection Trust can be structured for tax purposes as a U.S domestic trust – not subject to federal filing requirements:

- The asset protection structure can provide estate planning benefits of passing property to survivors and avoiding probate;

- The client retains the option to transfer funds to an overseas account established in the Offshore Trust;

- The Safety Valve Feature is popular in both offshore and domestic trusts:

Offshore Conversion Asset Protection Trust

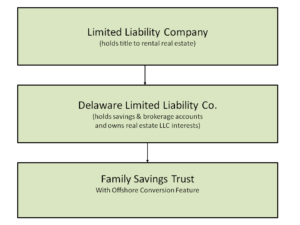

The Offshore Conversion Asset Protection Trust is designed to allow a domestic trust to be converted into an Offshore Trust at a future point. The Offshore Trust is not established at the time the plan is originally created. Instead, an agreement is made with an overseas trust company allowing for the conversion of a domestic trust to an Offshore Trust at a later date.

Under this structure the Client’s asset protection plan is usually built around a strong domestic structure. The details of the asset protection plan depend on the type of assets involved and the Client’s circumstances, but one example might look like this:

This arrangement operates well as a domestic asset protection plan. If differs from the Safety Valve Trust because the Offshore Asset Protection Trust is not established at the time the plan is created. This arrangement saves on the costs associated with forming and maintaining an Offshore Trust, which involve both legal and trustee company fees.

The Offshore Conversion Trust is based upon a legal agreement with one of the offshore trustee companies-typically a Cook Islands Trustee- that it will accept the Cook Islands trust and will serve as trustee at the point (if ever) the trust is converted to an Offshore Asset Protection Trust. This agreement acts as an insurance policy that the asset protection advantages of the Offshore Trust can be achieved even at a later date. The Cook Islands trustee companies charge an annual fee for this guarantee but the amount is substantially lower than the normal trustee fees of a fully registered Cook Islands Trust.

An asset protection planning structure may be formed with domestic entities or can be enhanced with Offshore Asset Protection Trust features, depending on the nature of the client’s assets and the liability risks faced. If an offshore component is appropriate there are a variety of strategies which should be considered based on the facts of the case and the client’s personal and financial circumstances.

Submit the Legal Services Request to send us questions, arrange a free initial consultation, or to receive an online Asset Protection Plan Design and Quote. All communications with prospective clients are protected under the California attorney–client privilege. As attorneys we must keep all client communications confidential and are prohibited from disclosing any information to any third party.