LAW OFFICE OF

ROBERT J. MINTZ

Exclusive Legal Representation For Your

Asset Protection Planning Needs

Asset Protection

Estate Planning

International Tax

Business Planning

LAW OFFICE OF

ROBERT J. MINTZ

Exclusive Legal Representation For Your

Asset Protection Plannings Needs

Asset Protection

Estate Planning

International Tax

Business Planning

Family Limited Partnership

The Family Limited Partnership (FLP) is an excellent device for providing a high degree of asset protection for family wealth.

.

When used as part of a properly designed strategy, the Family Limited Partnership can also provide significant income and estate tax savings advantages.

Family Limited Partnership Advantages

- Asset protection

- Flexible Design

- Separates ownership and control

- Efficient to Own and manage

- Permits transfers of fractional interests

- Can be structured to reduce income and estate taxes

What is a Family Limited Partnership?

A Family Limited Partnership is a type of limited partnership that is designed specifically to hold and protect family assets. An FLP consists of one or more general partners and one or more limited partners. The same person can be both a general and a limited partner, as long as there are at least two legal persons in the partnership. The general partner is responsible for the management of the affairs of the partnership and has unlimited personal liability for all debts and obligations. Limited partners have no personal liability and stand to lose only the amount contributed to the partnership.

Using Family Limited Partnerships for Asset Protection

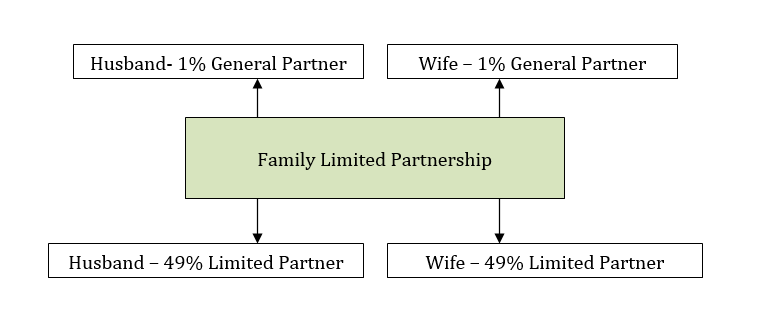

Under the typical arrangement, the FLP is set up so that one or more family members are each general partners. As an example we can use Husband and Wife as the family members setting up the FLP for asset protection. Alternatively, an entity such as an LLC, controlled by Husband and Wife or other family members, can be general partner. Often the general partner will own only a nominal one or two percent partnership interest. The remaining interests are in the form of limited partnership interests.

When used for asset protection, the question of who should own the limited partnership interests is an important consideration.

Most often the FLP is used to hold what are known as “Safe Assets. These are assets which by themselves are unlikely to generate lawsuit liability. Bank and brokerage accounts, life insurance policies and interests in other entities can usually be held in the FLP. ‘Dangerous Assets”- those which may produce liability such as real estate or business ownership, are generally segregated to protect the Safe Assets from liability risks.

When the transfers are complete, direct ownership of the FLP assets by Husband and Wife has been converted into another legal form. Instead of direct asset ownership, they own a controlling interest in the FLP and it is the FLP which owns the assets. As general partners, they have complete management and control over the affairs of the FLP and can buy or sell any assets they wish. They have the right to retain funds from the sale of any partnership assets or they can distribute these proceeds out to the partners.

Creditor Cannot Reach Assets

Now, let us see what happens if there is a lawsuit against either Husband or Wife. Assume that Wife owns a business and some time after setting up the FLP there is a lawsuit and a judgment against her for $1,000,000. The plaintiff in the action is now a judgment creditor and will try to collect the $1,000,000 from both Wife and Husband.

The judgment creditor would like to seize their bank accounts, investments and other property in order to collect the amount which he is owed. However, he discovers that Husband and Wife no longer holds title to any of these assets.

Can the creditor reach into the partnership and seize the property in the FLP?

The answer is no. Under the provisions of the Uniform Limited Partnership Act the creditor of a partner cannot reach into the partnership and take specific partnership assets. The creditor has no rights to any property which is held by the partnership. Since title to the assets is in the name of the partnership and it is the Wife and Husband- rather than the partnership- which are liable for the debt, FLP assets may not be taken to satisfy the judgment.

- The asset protection benefit of FLP is that a judgment creditor of a partner is not permitted to seize the assets of the FLP.

Although the judgment creditor of a partner cannot directly seize assets of the FLP, the creditor is generally permitted to obtain a charging order and may be permitted to foreclose on the partnership interests. For these reasons, to achieve asset protection goals, partnership interests in the FLP are usually owned by a Family Savings Trust.

Submit the Legal Services Request to send us questions, arrange a free initial consultation, or to receive an online Asset Protection Plan Design and Quote. All communications with prospective clients are protected under the California attorney–client privilege. As attorneys we must keep all client communications confidential and are prohibited from disclosing any information to any third party.